Roth Maximum 2025

Roth Maximum 2025. If you get to the end of the year. After 15 years, 529 plan assets can be rolled over to a roth ira for the beneficiary, subject to annual roth contribution limits and an aggregate lifetime limit of $35,000.

The update forecasts a $1,000 boost to this year’s 401 (k) elective deferral limit of $23,000, which would bring the 2025 limit to $24,000. The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you’re younger than age 50.

The Maximum Amount That Can Be Moved From A 529 Plan To A Roth Ira During An Individual’s Lifetime Is $35,000.

Your personal roth ira contribution limit, or eligibility to.

The Roth Ira Contribution Limit For 2024 Is $7,000 For Those Under 50, And $8,000 For Those 50 And Older.

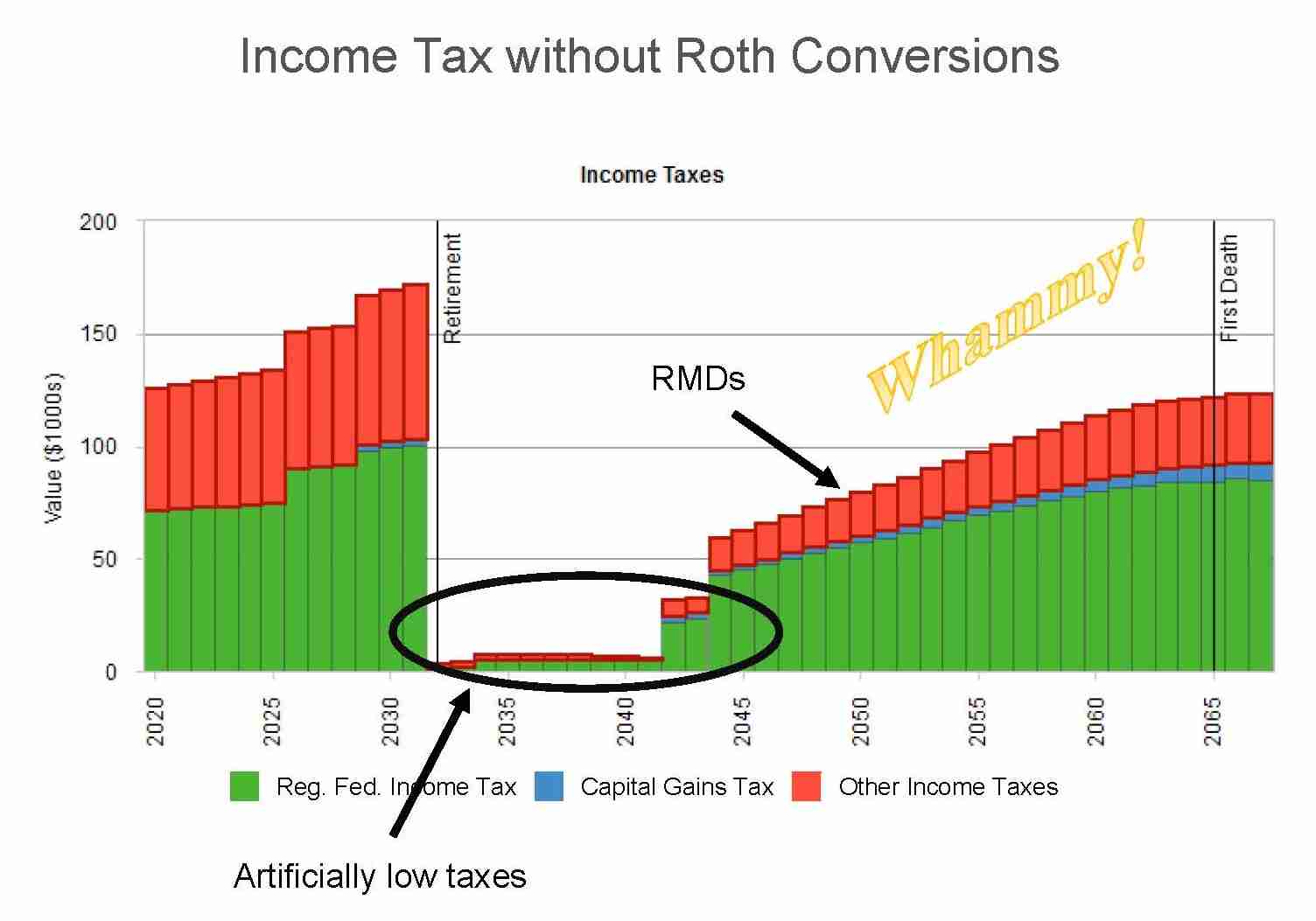

Federal employees planning to retire in 2024 or 2025, or those who are already retired, may have a unique ability to create an even larger “roth conversion.

Roth Maximum 2025 Images References :

Source: hospitalmedicaldirector.com

Source: hospitalmedicaldirector.com

The Closing Window Of Opportunity For Roth IRA Conversions What I've, If you invested the current maximum $7,000 annually in an ira and earned a 7.5% average annual return on that money, you'd end up with over $313,000 after 20 years. The 529 to roth ira.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

Which Retirement Plan Is Best for You? Retirement Account Guide Top, Your personal roth ira contribution limit, or eligibility to. See roth ira contribution limits for tax years 2018 and.

Source: www.youtube.com

Source: www.youtube.com

Tax Brackets Change in 2025. Should My Roth Strategy Change in, Starting in 2026, individuals that make over. The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

Source: feneliawginni.pages.dev

Source: feneliawginni.pages.dev

Roth Ira Contribution Limits Calendar Year Denys Felisha, (that contribution limit is up. I was contributing to my schwab ira today (jan 29, 2024), and it gave the option to contribute to years 2023, 2024, and 2025!

Source: topdollarinvestor.com

Source: topdollarinvestor.com

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, What is the deadline to make a contribution? Federal employees planning to retire in 2024 or 2025, or those who are already retired, may have a unique ability to create an even larger “roth conversion.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021, Only funds that have been in the 529 for at least five years (as well as the earnings on those contributions) may be moved to the roth ira. The secure 2.0 act is a recently enacted significant piece of legislation that has brought about substantial changes to the retirement account rules in the united states.

Source: hospitalmedicaldirector.com

Source: hospitalmedicaldirector.com

The Closing Window Of Opportunity For Roth IRA Conversions What I've, What is the deadline to make a contribution? Federal employees planning to retire in 2024 or 2025, or those who are already retired, may have a unique ability to create an even larger “roth conversion.

Source: shawneewklara.pages.dev

Source: shawneewklara.pages.dev

Roth Ira Limit 2024 Married Cyndy Doretta, If you're age 50 and older, you. As kiplinger has reported, if you are younger than 50, the maximum amount you can contribute to a roth 401(k) for 2024 is $23,000.

Source: carmichael-hill.com

Source: carmichael-hill.com

Converting an IRA to a Roth IRA after age 60 Carmichael Hill, See roth ira contribution limits for tax years 2018 and. What is the deadline to make a contribution?

Source: esmebmicaela.pages.dev

Source: esmebmicaela.pages.dev

2024 Roth Maximum Contribution Gina Phelia, (that contribution limit is up. Is it allowable to make an.

Your Personal Roth Ira Contribution Limit, Or Eligibility To.

The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

Can A Minor Contribute To An Ira?

The proposal might limit rollovers into roth iras and require some ira holders to take big distributions.